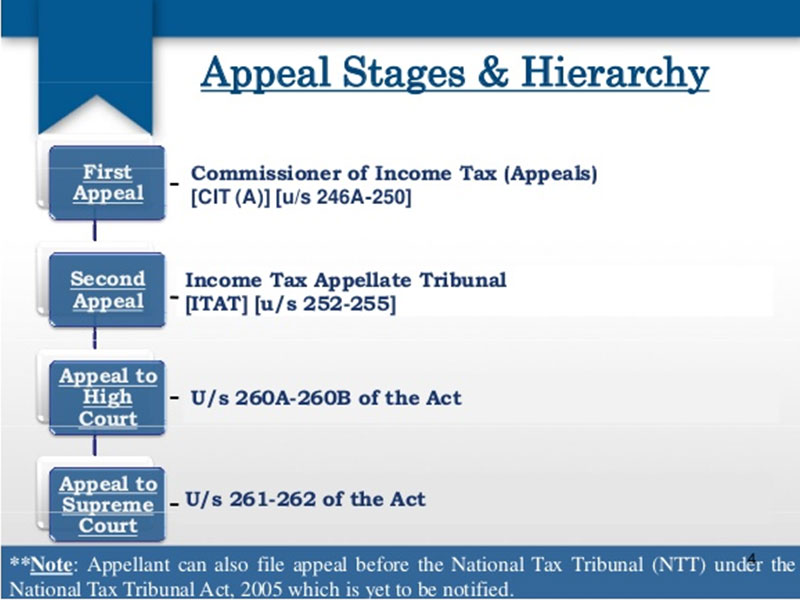

If the taxpayer is aggrieved by an order of the Income tax officer, in such a case he can file an appeal against the order of the Income tax officer before the Commissioner of Income-tax (Appeals). There are cases where the Income tax Officer treats the non-taxable income as taxable and does not allow claim of expenses though allowable, which leads to payment of additional income tax which he is not supposed to pay. In both the situations, the assessee is suffering losses due to ignorance of law and also its wrong interpretation. In such cases it becomes necessary to file appeals before such orders rather than paying tax as determined due to fear or any other reason.

The Central Board of Direct Taxes had issued a new Form No. 35 for filing an appeal before the Commissioner of Income-tax (Appeals). Further, e-filing of Form has been made mandatory for persons for whom e-filing of return of income is mandatory. Appeal must be filed within 30 days the date of service of order sought to be appealed.

The appeal before the Commissioner of Income-tax (Appeals) has to be filed after payment of prescribed fees and along with the specified documents. For filing an appeal before the Commissioner of Income-tax (Appeals), one must take the help of the legal consultants / Chartered Accountants to avoid any future disputes / discrepancies.

Once the appeal is filed before the Commissioner of Income-tax (Appeals) in Form No. 35, the date is fixed for hearing by the Commissioner of Income-tax (Appeals) in relation to which the appellant receives Notice under section 250 of the Income tax Act, 1961 intimating the date fixed for hearing, wherein the appellant is required to put forth his contentions in the form of Written Submission and Paper book. Written submission is a document where we submit the details and explanations with respect to the subject matter of the appeal. One has to be very particular while compiling the submission and there should be direct nexus with the subject matter of the appeal rather than submitting irrelevant details / explanations. On the other hand Paper book is set of supporting documents compiled in support of contentions described in the written submission.

Proper and appropriate submission decides fate of the case of the tax payer and also future of the tax payer. Any improper and inaccurate submissions leads to addition of income to the returned income of the tax payer even if not supposed to pay and further consequent tax and interest thereon, penalty and prosecution. So, a carefully drafted submission along with paper book is always desirable in respect of appeal filed before the Commissioner of Income-tax (Appeals).

If the taxpayer is aggrieved / not satisfied even by an order of the Commissioner of Income tax (Appeals), in such a case appeal can be filed against the order of the Commissioner of Income-tax (Appeals) before the Hon’ble Income tax Appellate Tribunal. It is important to note here that the Income tax Appellate Tribunal is the highest fact finding authority i.e. decision rendered by the Income tax Appellate Tribunal on the basis of facts of the assessee is final. No further appeal can be made against the order of Hon’ble Income tax Appellate Tribunal unless and until the matter of law is involved.

Appeal before The Income tax Appellate Tribunal is filed in Form No. 36 specified by the Central Board of Direct taxes physically with the Income tax department. Appeal must be filed within 60 days the date of service of order of the Commissioner of Income-tax (Appeals).

The appeal before The Income tax Appellate Tribunal has to be filed after payment of prescribed fees and along with the specified documents. For filing an appeal before The Income tax Appellate Tribunal, one must take the help of the legal consultants / Chartered Accountants to avoid any future disputes / discrepancies.

If the appeal is filed against the order of the Commissioner of Income-tax (Appeals) before the Hon’ble Income tax Appellate Tribunal by the aggrieved party whether the department (Income tax Officer) or the tax payer. Notice of Intimation is sent by the Hon’ble Income tax Appellate Tribunal to the Other party and such other party within 30 days of receipt of notice can file memorandum of cross objection in Form 36A physically.

Such memorandum of cross objections can be filed even if no appeal is filed by the tax payer or the Income tax officer i.e. the Cross objections can be filed in support of the order passed by the Commissioner of Income-tax (Appeals). On filing, a Cross objections assumes the character of an appeal and such memorandum shall be disposed of by the Appellate Tribunal as if it were an appeal presented before him and all the rules of appeal, so far as may be, shall apply to such cross objections.

The fact is beyond doubt that decision rendered by the Income tax Appellate Tribunal on the basis of facts of the assessee is final. No further appeal can be made against the order of Hon’ble Income tax Appellate Tribunal unless and until the matter of law is involved. However, with a view to rectifying any mistake apparent from the record, the Income tax Appellate Tribunal may amend its any order on receipt of Miscellaneous application. There are many practical situations where ITAT orders are passed arbitrarily and prejudicially without considering all the facts and circumstances of the case. Thus, if any such situation arise where the case is not discussed in detail, the aggrieved party has option to rectify mistake apparent from record by raising miscellaneous application before ITAT

Miscellaneous application must be filed within six months from the end of the month in which the ITAT order was passed. The Miscellaneous application before The Income tax Appellate Tribunal has to be filed after payment of prescribed fees of Rs 50/- and along with the specified documents. For filing an Miscellaneous application before The Income tax Appellate Tribunal, one must take the help of the legal consultants / Chartered Accountants to avoid the risk of being rejected as an application shall clearly and concisely set out the mistake apparent from the record of which rectification is sought.

After the appeal is filed before the filed before the Hon’ble Income tax Appellate Tribunal whether by the tax payer / department, the date is fixed for hearing by the Hon’ble Income tax Appellate Tribunal which is intimated to both the parties. On the decided date both the parties (appellant and respondent) have to appear, brief written synopsis containing relevant observations from the order of the lower appellate authority and order of Income tax officer is to be filed by the appellant, thereafter argument on the grounds of appeal takes place before the bench of Hon’ ble Income tax Appellate Tribunal. After hearing both the parties, the hon’ble bench decide the case on merit.

Proper and appropriate argument on critical points decides fate of the case. As it is the highest fact finding authority, no further appeal can be made against its order. Thus, any improper and inaccurate submissions lead to addition of income to the returned income of the tax payer even if not supposed to pay and further consequent tax and interest thereon, penalty and prosecution. So, a carefully drafted synopsis and arguments is always desirable in respect of appeal filed before the Hon’ble Income tax Appellate Tribunal.

Appeal against Appellate Tribunal’s order lies with the High Court on the question of law, for which the tax payer or the Commissioner of Income tax (Appeals) within 60 days of receipt of the order of the Appellate Tribunal, has to make an application to the Hon’ble Income tax Appellate Tribunal to refer to the Hon’ble High Court any question of law arising out of the Order of the Appellate Tribunal. Upon receipt of such application The Appellate Tribunal draw up a statement of the case and refer it to the Hon’ble High Court within 120 days of receipt of such application.